If you have a careful read through the detail of your property insurance policy, you’ll typically come across a clause or condition relating to the occupancy status of the property.

Typically you’ll find that property insurance providers, like us at UKinsuranceNET, provide policies which are based on the premise that your property is occupied on a more or less permanent basis:

- allowance is of course made for occasional holidays or other trips away but there will be a maximum number of consecutive days specified and after this time you may need to purchase vacant property insurance if you want your insurance protection to continue;

- different providers may specify different periods and there may be additional criteria relating to the occupancy status of the property when you first took your policy out;

- with many policies, this figure may be around 30 days although there are others which can have a maximum figure of up to 90 days (depending on certain circumstances);

- unoccupied property insurance may be something that is particularly relevant for landlords and if you have a particularly high turnover of tenants or are anticipating carrying out some refurbishment or renovation work in the near future then you may wish to look out for policies with a higher maximum period;

- you may wish to bear in mind though that these requirements relate to owner occupier properties too and special cover may be required to cover periods like extended business trips or probate and the like;

- once you have purchased a policy to cover the period of un-occupancy, you may wish to read through its terms and conditions, as these may be different to those of your regular cover;

- for example, you may be required to drain down your heating and water systems or in some cases to leave your heating on at a low level during the winter months;

- you may also be asked to keep your property looking as lived in as possible to discourage the attentions of thieves, vandals or squatters;

- this could involve keeping any garden areas looking tidy and making sure that there is no accumulation of junk mail left in the letterbox;

- some policies may ask that you leave lights on timers and you should try and arrange for someone to visit the property on a regular basis to ensure that everything is ok and to fix anything that isn’t;

- of course, once you are back in your property on regular basis or have had new tenants move in, some unoccupied property insurance policies can be easily transferred to take account of the changing status;

- you’ll also find that some providers are more than happy to offer interest free direct debit facilities.

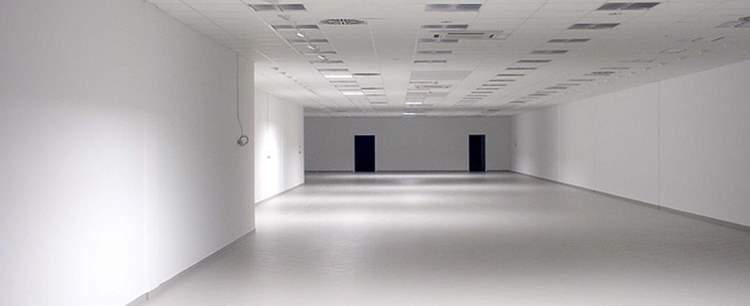

The risks that empty properties face are different to those that can typically be an issue for an occupied property. Making sure that you have appropriate insurance cover in place to cover those risks is essential if you are keen to protect your property investments.